Our latest

social posts!

Click the link below to follow us on your favourite socials!

See our socials

Home buying costs to consider!

It's always good to know up front what things are going to cost, so we've listed below the costs you can expect to pay when buying a home:

- Deposit

- Mortgage arrangement fee

- Remortgaging

- Application to offer: often 1-3 weeks

- Legal/admin work: 4-8 weeks in total

- Lender application fee

- Valuation fee

- Stamp duty taxes

- Legal / Conveyancing fees

- Survey fees

- Specialist report fees

- Search fees

- Early repayment charges (ERC)

- Bank transfer fees

- Moving fees

- Broker fee

Listen to the right advice!

When it comes to mortgages, well-meaning advice from friends or family can often miss the mark. Other people's tips & tricks might not cover the full picture, so here’s why you should talk to a qualified mortgage broker:

- Every Lender is Different! Hundreds of lenders, each with unique criteria, affordability calculators, and nuances and what worked for someone else may not suit your financial situation.

- Expert Guidance Matters - a professional broker tailors advice to your needs, navigating complex lender requirements.

- Save time, stress, and potentially money by getting it right first time.

At Naomi Financial, we’ll guide you through the maze of lenders to find the best mortgage for your circumstances.

What are the timescales?

Mortgage timescales - what to expect!

Whether you’re buying your dream home or remortgaging, knowing how long the process takes can help you plan with confidence:

Purchasing a Home

- Mortgage application to offer: typically 2-4 weeks

- Overall purchase process: 12-16 weeks (but can vary depending on solicitors, surveys & chains)

- Remortgaging

- Application to offer: often 1-3 weeks

- Legal/admin work: 4-8 weeks in total

At Naomi Financial, we guide you through every step and keep things moving as smoothly as possible.

What support would you get from sick pay?

You protected your home. Now protect what matters most.

Buying a home is a huge milestone. But here's what many people forget:

If life throws you a curveball — illness, job loss, worse — how would you keep up with your mortgage?

That's why this week I’m breaking it all down in my new Protection Series. No jargon. No fluff. Just clear, simple advice on:

- Life Insurance

- Critical Illness Cover

- Income Protection

- Family Income Benefit

- Mortgage Payment Cover

- Mortgage Payment Cover

- Accident Sickness and Unemployment Cover

- Home Insurance

Fun fact Friday!

Did you know that I originally set out to be an equestrian physiotherapist?

Straight out of school, I went to equestrian college while working on a dressage yard - horses were my whole world growing up!

But life had other plans! To save for a dream trip to New Zealand, I took an admin job at Skipton Building Society - and that’s where it clicked.

I unexpectedly fell in love with mortgages and helping people on their journey to homeownership.

From horses to houses, it’s been quite the ride - and now I get to keep horses as a hobby, and mortgages as my passion.

We love to solve problems!

Finding the right mortgage isn't just about the lowest rate!

As mortgage brokers, many people think our job is simply to find the cheapest deal. While securing you the best possible rate is always a top priority, the reality is that the best deal on paper isn’t always achievable due to individual circumstances.

Arranging a mortgage is often like solving a Rubik’s Cube, everything seems to be lining up, and then one piece throws the whole puzzle off. That’s where our expertise comes in.

A big part of what we do is problem-solving. We use our knowledge & long-standing relationships in the industry to navigate complex situations and find solutions that work for you.

Over the coming weeks, we’ll be sharing real-life case studies to show how we've helped clients overcome challenges, whether related to income, employment, age, property type, debts, or the kind of borrowing required.

To get a mortgage approved, all the pieces need to align. And that’s what we’re here to help with.

If you're facing a mortgage challenge - or just want expert guidance - feel free to get in touch. We'd be happy to help!

All the types of deposits

When buying a home you will often need to put down a deposit (but not always)

Each lender is different as to what they will/won't accept and of course your personal circumstances play a part too.

Here are some types of deposits that are accepted:

- No deposit

- Own savings

- Personal loan

- Gifted from family

- Gifted from friends

- Equity in the property gifted

- Landlord deposits

- Employed deposits

- Equity released from another property

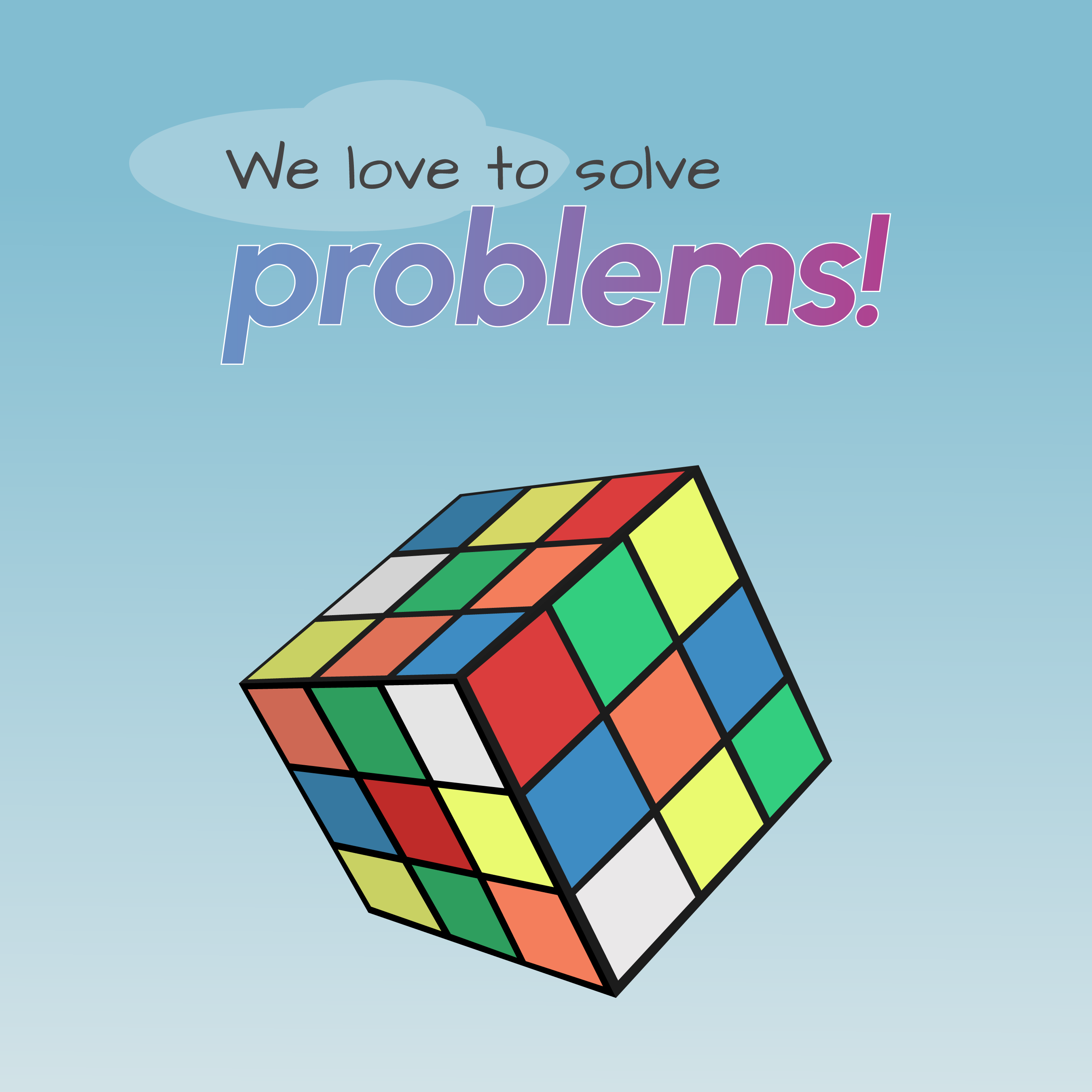

What documents do I need?

It's a very busy time at the moment with a lot of people buying and remortgaging so we thought we'd do a recap on one of the most asked questions:

'What documents do you need?'.

We've put together a handy little checklist of documents that you will need to help you prepare for your appointment and mortgage application:

- Proof of identity: Passport or driver's license

- Proof of address: Utility bills or bank statements

- Proof of income: Latest 3 months payslips or 3 years accounts/tax returns

- Bank statements: Latest 3 months bank statements

- Proof of deposit

- Additional income proof: Rental income, bonuses, benefits, pension etc

- Property details: Value and address

- Solicitors details

Looking to get a Buy To Let?

Whether you’re looking to start your property investment journey or expand your portfolio, a Buy-to-Let mortgage could be the key to making it happen.

- Potential rental income

- Long-term investment growth

- Flexible mortgage options

Get in touch today to chat about Buy-to-Let mortgages!